Hi everyone, and happy pandemic groundhog day. This week, a particularly pleasant Californian yelled at me for wearing a mask (yes, you read that correctly), so I’m not sure we’re making much progress…

TikTokracy, and tech geopolitics (again)

Last week, I wrote briefly about India’s ban of 59 Chinese apps, including TikTok. [I haven’t decided if linking to my own writing is roughly equivalent to talking about myself in the 3rd person, so I’m probably going to keep doing it until I come to my senses.] The core argument advanced by the Indian government was that the Chinese companies behind those apps could not be trusted to treat data on Indian citizens safely and ethically, thus constituting a national security risk. The impact on homegrown Indian apps is as yet unclear; I expressed my doubt that robust local competitors could be built (and sustained), but I could be wrong, as there are early signs that certain Indian startups are experiencing a tailwind (South China Morning Post) in the ban’s aftermath. I still think the bulk of the shifted attention will accrue to other mega-players, like Instagram (which recently began testing its TikTok-ish Reels feature in India, per Tech Crunch). I’ll be curious to see how India, or other nations entertaining similar bans, decides to treat Chinese investors who are deploying capital in local companies (tech or otherwise). Chinese firms of one flavor or another have been—and continue to be—significant capital providers in entrepreneurial ecosystems all over the world; will capital be viewed differently from technology?

Of course, the India ban comes in the wake of an actual military skirmish between Indian and Chinese troops. Yet, the action against the Chinese apps isn’t limited to India. Indeed, this week, Mike “Father” Pence (US VP) reinforced Secretary of State Mike Pompeo’s claim (Nikkei) that the US was considering bans of Chinese apps, including (brace yourself) TikTok. Thus far, the Trump administration has primarily focused its “China tech” strategy (as it were) on Huawei, ZTE, and the risk of Chinese-controlled 5G infrastructure. While the impact of this scenario could be real and far-reaching, it’s a more academic concept for most of us. An explicit ban of TikTok would feel much more immediate and, thus, likely to garner broader consumer and media attention. [Between this story and the TikTok impact on Trump’s poor June rally attendance (NYT), TikTok is showing up more on the “consequential news” front than one would have suspected (hoped?). 2020!]

The US is not alone in expressing concern over Huawei, a company whose approach to providing 5G infrastructure globally could be read as the spiritual cousin to China’s Belt & Road Initiative. This week, the UK announced that it might reverse its earlier decision to greenlight Huawei’s role (Bloomberg) in building 5G infrastructure, citing US sanctions on the company. Further, Huawei technology would be removed from 4G/3G products in the UK, while new equipment sales would be banned.

The French followed suit, with their cybersecurity agency (ANSSI) encouraging French telcos to avoid engaging with Huawei (Reuters). Meanwhile, the Germans are embroiled in a controversy over whether Deutsche Telekom is deepening its relationship with Huawei (Politico), or disentangling itself from the Chinese company. Simultaneously, tech companies like Facebook, Twitter, and Google are starting to respond to China’s new national security legislation (WSJ) and its impact on Hong Kong, where, amongst other things, requests for user data would no longer require a court order and could, theoretically, extend to accounts across the globe that are suspected of violating the law. As we accelerate towards the US election in November—with US-China relations an unavoidable topic—it feels inevitable that these stories will continue to occupy international attention. If you’re interested in a deeper dive into the tech-world implications of the Hong Kong national security law, I’d encourage you to read Rita Liao’s piece on Tech Crunch and Bill Bishop’s coverage in Sinocism.

Your ears on drugs (part two)

Way back in the early days of Trillium, I wrote about the “8D audio” trend that had caused legions of panicked Internet denizens to ask Google whether the newfangled audio experience was dangerous (A: No). 8D audio is typically a high quality audio file that’s been produced with panning effects such that sound appears to move from left to right in your headphones. It’s kind of a production party trick, and it’s fun for about 17 minutes.

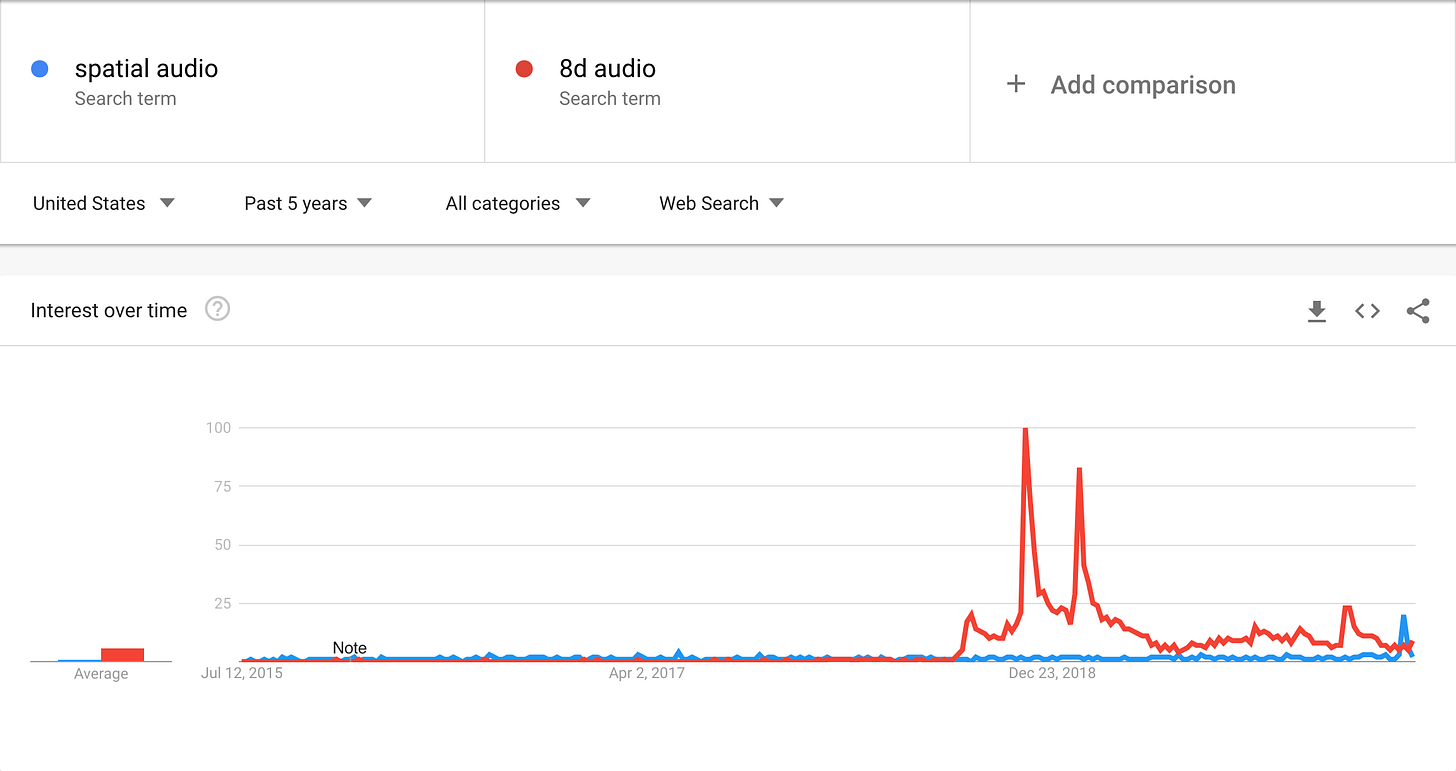

Recently, though, Apple announced that AirPods Pro will receive a “simulated surround sound” capability (CNET). While few consumers are aware of it, the AirPods (and many other top-of-the-line “hearables”) contain accelerometers and gyroscopes that can be used to follow a consumer’s head movements and frame of reference (Donny). While others, including Sony and Dolby, have equivalent offerings, it’s interesting to see Apple pushing the boundaries of aural experiences, particularly when it comes to movie & gaming applications. While 8D audio peaked as a trend in 2018-2019, spatial audio is just getting going:

There are a range of potentially compelling uses beyond consuming entertainment: think about fitness and real-world “augmented reality” applications that blend some sort of pre-produced experience with dynamics influenced by your physical surroundings. While audio augmented reality has been hyped over the past few years, it has yet to deliver on its promise. Bose, widely seen as a leading player in the space, recently shut down its audio AR efforts (Verge) and admitted that the product area “didn’t become what [they] envisioned.” I never liked the Bose Frames sunglasses as a delivery vehicle (Google Glass PTSD?), and prefer the idea of using existing headphones as a vehicle to reach consumers, even if with a less immersive experience. We’ll see if Apple is able to use the AirPods Pro to do exactly that.

Boomerang: stories from weeks past

Whatsappdate: Every week or so, this story reverses course, which makes it rather on point for this particular section of the newsletter but rather irritating for me. In summary, Whatsapp Pay launched in Brazil, and then it was shut down, and now it might be okay again (NYT). The Brazilian antitrust body, Cade, has revoked its decision to suspend the payments service. However, Whatsapp Pay continues to have issues in Brazil, as the central bank ordered Facebook to suspend the app’s operations, reportedly because Visa & Mastercard needed to seek the central body’s permission to integrate with Whatsapp. Who knows where we’ll be next week.

While we’re talking about Whatsapp, I should mention that Whatsapp Business announced that it now has 50M monthly active users (Tech Crunch), with India & Brazil as the top two markets. The app is also using QR codes to enable offline-online discovery, effectively borrowing from the WeChat “2D barcode” playbook. I’m particularly bullish on Whatsapp Business for longtail merchants and indie sellers, many of whom will already be familiar with the app from their usage of the consumer product.

Phone a friend: Just when I thought they were out…Wirecard, the allegedly and elaborately fraudulent German fintech company (WSJ), might receive emergency financing from Deutsche Bank (NYT). In a delightfully teutonic statement that I feel compelled to reproduce verbatim, a Deutsche Bank spokesperson said, “We are, in principle, prepared to provide this support…if such assistance should become necessary.” The Wirecard CEO is out on bail, but his COO still cannot be found (Reuters). Some say he’s in the Philippines. Others say China. The fact that no one can find this guy, in the camera-forward year 2020, is truly remarkable. I will close by presenting an illuminating visual of Wirecard’s YTD stock performance (currently at <3% of its mid-June high).

Sequoia deepens roots in India and Southeast Asia: Tree puns! Per Tech Crunch, Sequoia has announced $1.35bn in venture and growth funds for investments in India and Southeast Asia. The growth fund comprises $825M of that total, and will presumably be used to double down on promising regional investments in Sequoia’s grove/portfolio. There continues to be no question about Sequoia’s increasing level of dominance in India and, more recently, across Southeast Asia. The firm started its Surge program for early stage ventures in these markets, and has continued to evolve its programming (and capital allocation strategy) to meet the needs of local founders. It’s interesting to see another dedicated fund raised by Sequoia, given that their last IN/SEA fund closed in 2018 at a tidy $695M. As noted in the Tech Crunch article, the timing is good (for Sequoia, and for Indian founders), given the rising tensions between India and China and the knock-on effects for capital availability in the country.

In my conversations over the past several months with investors across Southeast Asia, I’ve often heard complaints about the availability of early (pre-Series A, but especially “professional” tech angel) stage capital, along with concerns about the relative paucity of experienced startup advisors. It makes intuitive sense, as many of the existing private equity vehicles in Asia writ large can shift some of their focus to later stage tech “growth” deals, which can be assessed using the quantitative frameworks that those firms rely upon in other sectors. At the early stage, with little to no available data on which to base a decision, the investment process is significantly more fraught. I’ll be curious to see how Sequoia’s influence on the region changes investor and founder behaviors in the region.

Wait for it: Yes, Jio! In case you were concerned, the company is not having trouble finding additional investors. This week, Intel Capital added an oddly specific $253.5M to the pot (Bloomberg). While this sum pales in contrast to the 2Chainz-like largesse of other investors over the past several months, the perception is that the Intel investment has strategic value beyond the capital itself. One Jio exec cited Intel’s infrastructural capabilities pertaining to “next generation networks” (components of delivering 5G, specifically), while others have recognized Intel’s Internet of Things IP and ability to provide Jio with expertise that can help them build their own hardware, whether for consumer or industrial applications. Given the current tension between India and China, and the generally circumspect attitude towards Huawei as a provider of next gen mobile networks, the value of a homegrown alternative has never been higher.

The plot thickens: Along with Sequoia’s new fund, several Indonesian startups have made the news for their own fundraising activity. Payfazz, a YC company providing financial services to the un/under-banked in Indonesia, just announced $53M in new capital (Tech Crunch). Meanwhile, Indonesian beauty startup Social Bella added $58M from investors including Temasek (Tech in Asia). It’s interesting to see ongoing investment activity around fintech & payments, of course, but equally interesting to see an investor thesis continue to emerge around the rising middle class in Indonesia (and Southeast Asia more broadly). A few weeks ago, I mentioned that I expected more investment in the entertainment & “disposable income/casual consumption” categories. In the former category, streaming media services continue to be hot. In the latter, e-com & DTC retail remain dominant. However, there is durian amidst the roses: Traveloka, a darling of the SEA startup scene and a homegrown Indonesian unicorn, is apparently raising around $250M at a 17% discount to its last financing (Yahoo). As you might gather from the name, Traveloka is in the travel space. Spoiler alert: this hasn’t been a great year for that vertical. However, this down-round, along with layoffs across tech unicorns (including Oyo Indonesia furloughing 50% of its workforce), is an interesting counterpoint to the ongoing private market investment activity.

For your ears only

I recently discovered GoGo Penguin through the always awesome Passion of the Weiss blog. Honestly, the name gave me pause, but I’m glad that I persevered. The trio just released a new album on Blue Note and have a number of jazz influences, amongst other talents. You can get a good sense of their style by watching them performing “Kora” live:

In an uncharacteristic attempt to stay on topic, I thought I’d share another track involving “kora,” a West African instrument popularized by artists like Toumani Diabate. This one is a live performance by Ali Farka Touré (one of the most famous Malian guitarists) and Diabate:

See you all next week.

N